Welcome to My Blog

Reality check

Recently I was talking to a bank manager friend of mine ‘Jack’ about this current crazy housing market and it presents a picture that is at once dangerous and lacking anything that makes sense! Jack is seeing on an almost daily basis, clients who purchased properties...

Re-financing may be an option

Although low interest rates and a vigorous housing market continue to be the norm, Canadians are still saddled with the burden of high debt loads. According to recent stats, the ratio of debt to disposable income rose to 167.3% by the end of 2016. This means that...

Tell the TRUTH on your Mortgage Applications: Don’t get caught in Little White lies – or Fraud!

Would you: Walk into a store, fill your pockets with merchandise, then walk out without paying? Gas up your car at a service station, then peel rubber without paying? Endorse a cheque payable to someone else then cash it? When filling out a mortgage application...

Disturbing situations happening within our main banking institutions

'Sell to them or you will lose your job': Call centre employees for big banks reveal upsell pressures. Employees say customer calls for help used as opportunities to load them up with more debt. By Erica Johnson CBC News A recent article by Erica Johnson of CBC News...

The importance of Pre-planning Final Arrangements: How a CHIP Reverse Mortgage can help in estate planning for your loved ones.

Pre-planning your own or your loved one’s funeral arrangements is something that is sometimes difficult to think about. But it is something that simply should be done. No one wants to think about their own or their loved ones’ death any sooner than they must, but...

Should Senior Canadians consider a Mortgage?

Recently we discovered an article published by The Globe and Mail, ‘Seniors taking out mortgages – is it ever a good idea? By Diane Jermyn. The article follows a senior couple who are considering accessing funds locked up in their home equity by taking out a...

The importance of Remembrance Day – “Lest We Forget”

The importance of Remembrance Day – “Lest We Forget” “In Flanders fields the poppies blow Between the crosses, row on row, That mark our place: and in the sky The larks still bravely singing fly Scarce heard amid the guns below.” The immortal words of Lieutenant...

New Mortgage Rules

In response to concerns that some markets in Canada are ‘overheated’ and that Canadian debt levels continue to increase, Ottawa has announced new rules. These changes are meant to alleviate risk in Canada’s housing market but may have a significant impact on the...

Difficult times require sensitivity and understanding

The loss of a loved one. Difficult times require sensitivity and understanding. Losing a loved one is the most traumatic and emotional time in anyone's life. Life goes on, There will be strong emotions, intermittent fatigue, while still having to cope with daily life...

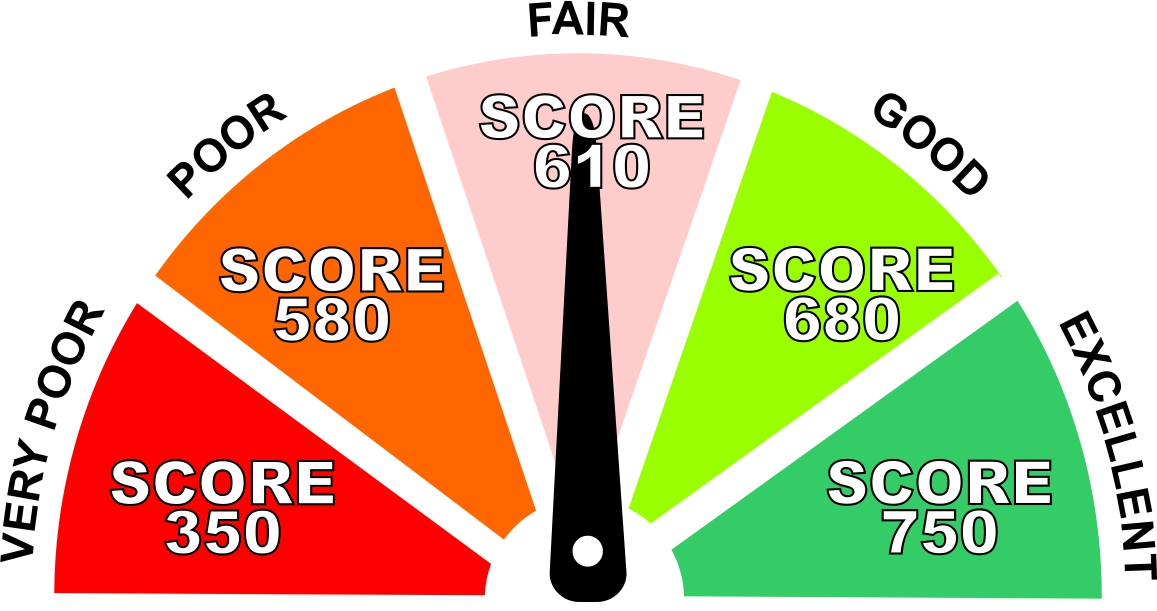

The Importance of Managing Your Credit Score

As a mortgage broker dealing regularly with clients having ‘Bruised’ or ‘Challenged’ credit (or any of the other euphemisms used to describe it!), I am constantly amazed at the lack of knowledge of some generations about this important financial measure. There is a...